Table of Content

You can further enhance your savings by switching to the most cost-efficient floating interest rate benchmark. Presently, there are base rate, the marginal cost of lending rate and repo-linked lending rate benchmarks. Of these, the RLLR is an external benchmark and is more transparent to the rate changes made by the Reserve Bank of India than the other benchmarks.

Fixed rates are normally higher than floating rates by 1–2%. There is also a third option of mixed interest rates, where interest is levied at a fixed rate at the beginning and then converted into a floating rate after a set period. Bajaj Housing Finance will update the current benchmark rates on this website in the event of a change. Bajaj Housing Finance charges an additional rate, called ‘spread,’ over the benchmark rate to arrive at the final lending rate.

How To Avoid Rejection Of Your Personal Loan Application

Despite that, the EMI constitutes below 50% of your net monthly income. The lender can approve such a repayment tenure if you don’t have any other obligation. I have chosen the LIC housing because i heard about them through my friends and relatives and the interest rates also little less compared to others. I bought the loan amount of Rs. 18 lakhs and the rate of interest is 8.40% and i have selected the tenure period of 25 years. Home loan EMIs are inversely related to the repayment term, making instalments dearer for a short tenor, but keeping interest accumulation in check. On the other hand, a long tenor results in easy and affordable EMIs, but higher interest accumulation.

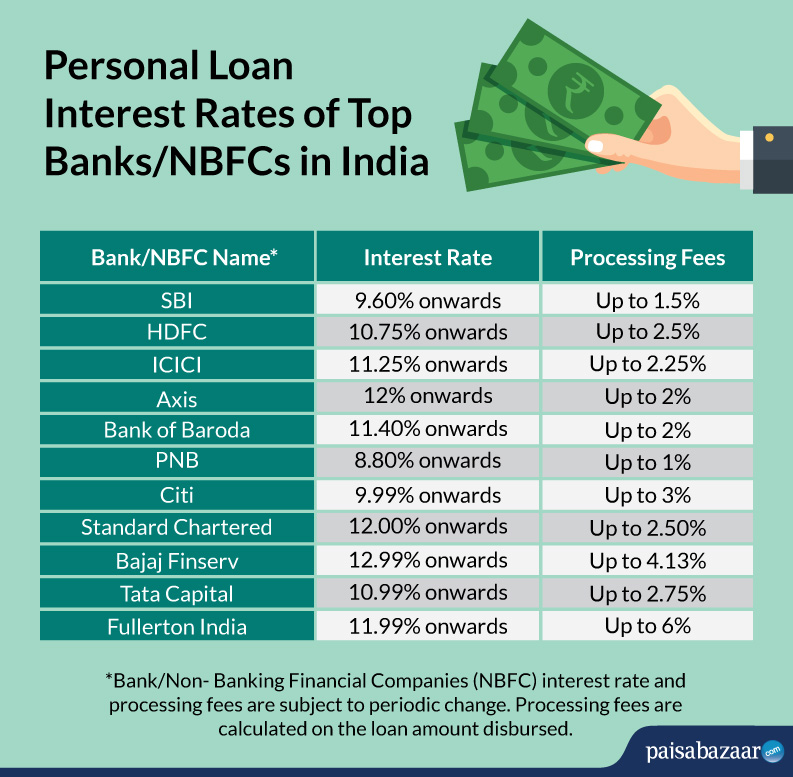

Your credit history and credit score is also helpful in getting desired home loan interest rates. Here are the interest rates offered by top banks in India. To buy a house through a home loan, we prefer the lowest home loan interest rates.

How to Get Low Home Loan Interest in India

Several factors affect the home loan interest, and it is important for you to learn about them as they impact how easily you can repay the loan. These factors also impact your EMIs as any change in interest rate is directly proportional to a change in the instalment amount you pay. The easiest way to secure the lowest possible Home Loan interest rate is to have a high CIBIL score. This is because a high score reflects a good credit history with various credit types in terms of your repayment track record and credit utilisation. You can claim tax exemption on amounts up to Rs. 1.5 lakhs on principal repayments under the Income Tax Act.

Applicant’s CIBIL score, loan amount, employment type, income levels as well as the gender of the applicant are some of the factors that determine the rate of interest on your home loan application. So, you can see a savings of around INR 10,76,956 (37,92,453-27,15,497) on reducing the tenure to 15 years instead of continuing it for 20 years. Yes, the EMI will rise by around INR 4,839 (37,308-32,469) when you choose a tenure of 15 years.

Finance for Professionals

The interest rates for HDFC home loan Mumbai starts from 6.75% p.a. Popular home loan schemes of HDFC includes, home loan balance transfers, HDFC Reach Home Loan. The eligibility criteria are related to your age, income, past repayment history and the cost & location of the property. They normally lend up-to 65%-70% of the monthly income as a home loan subject to your obligation. The eligibility criteria vary across the lenders, home loan schemes, FOIR & LTV % & CIBIL score requirement.

The interest rate you receive is set by the lender based on internal policies and market conditions. To calculate the total housing loan interest you will need to pay on your home loan, you can use a home loan interest calculator. This helps you compute your EMIs and the total cost of your loan. A home loan balance transfer facility allows you to switch your loan to a financial institution offering a reduced home loan interest. This is the easiest way to get a lower rate, but ensure you do a cost-benefit analysis before going ahead and this does include some fees and charges.

Home Loans In India – Interest Rates

To secure your dream house, you need a trustable entity that can guide you appropriately on your loan requirements. We understand you and your requirement and therefore provide you with the best housing loan in Mumbai. The rate at which banks borrow money from RBI is termed as the Repo rate. As the repo rate increases, the banks borrow money from RBI at higher interest rates and vice versa. This results in an increase in the home loan interest rates for individual borrowers. LoanCounsellor enables you to compare the home loan interest rates in Mumbai offered by different banks and financial institutions.

Andheri – Andheri is a hotspot for a number of corporate offices. It is also one of the most popular areas for residential properties. It is well connected with train network and main roads, making the daily commute easier for residents in and around this area.

In addition, a shorter repayment timeline helps you get a more affordable interest rate from the lender. Apply for a home loan online and get a step closer to fulfilling your dream of owning your house. Below are the floating interest rates for home loans and top up loans.

They have provided me a interest rate of 8% and there is no hidden charges deducted. They are having a pre-closure facility with some charges. I have take home loan directly through Aadhar Housing Finance Ltd. Make sure to consider all these factors before applying for a home loan to secure the best interest rate.

When you choose Sulekha, you get the best offers available in the market and negotiate your terms with the top service providers. Our professionals guarantee 100% customer satisfaction while delivering the service on-time. This was a bank which has given the option from the property advertiser and they have given me a sub vention plan where there is 2 years free for without paying a premium for the initial 2 years. Recently I availed home loan from Aadhar Home finance, they charged 11% of interest for the principal of Rs. 22 lakhs for the loan period of 20 years.

No comments:

Post a Comment